If you and a neighbor shared the cost of qualifying property to benefit each of your main homes both of you can take the nonbusiness energy property credit.

Nonbusiness energy property credit roof.

Must be an existing home your principal residence.

Tax credits for non business energy property are now available for products installed on the taxpayer s primary residence in the u s.

This credit is worth 10 of the cost and a maximum of 200 and 500 for windows skylights and doors respectively.

The home must also be located in the united states.

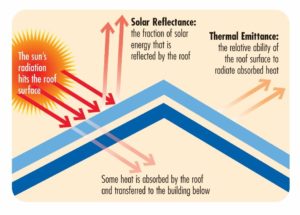

Asphalt and metal roofs.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

You figure your credit on the part of the cost you paid.

The residential renewable energy tax credit there are three applicable percentages you can claim.

To qualify for the credit the qualified roofing product must have been purchased and placed into service during the applicable tax year on an existing home not new construction which was your primary residence and which you owned.

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

26 for property placed in service after december 31 2019 and before january 1 2021.

A and b which related to credit equal to the sum of 10 percent of the amount paid for qualified energy efficiency improvements and the amount of energy property expenditures and provided limits on credits and expenditures.

A and b and struck out former subsecs.

This credit is worth a maximum of 500 for all years combined from 2006 to its expiration.

The residential energy credits are.

Details of the nonbusiness energy property credit extended through december 31 2019 you can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

10 of cost up to 500 or a specific amount from 50 300.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

The nonbusiness energy property tax credit in the united states provides a nonrefundable personal tax credit for federal income tax purposes for making a home more energy efficient.

Unlike a deduction which lowers taxable income a tax credit reduces the actual tax paid dollar for dollar.

The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020.

Of that combined 500 limit.